Who we are

Our profile

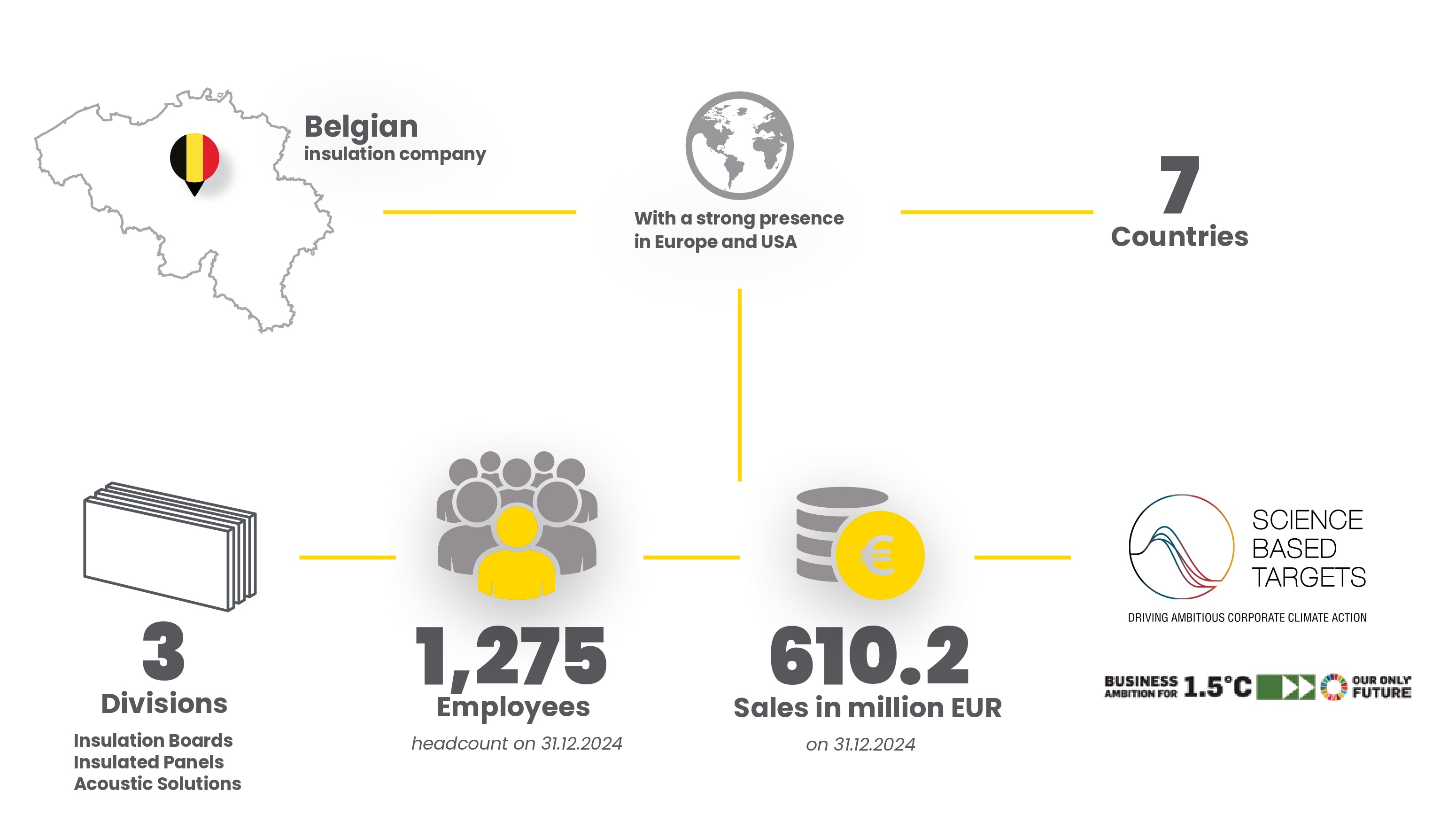

Facts & Figures

Recticel around the world

Our activities

Recticel Group is a well-known and respected company, with origins dating back as far as 1778. We have completed a strategic transformation of divestments and acquisitions to focus solely on our insulation activities. As such we make an important contribution to a world that is increasingly driven by the energy transition and the need to safeguard our planet’s future.

We are structured around three divisions, Insulation Boards, Insulated Panels, Acoustic Insulation and a proud home to the following brands:

- Recticel Insulation designs polyurethane thermal and thermo-acoustic boards for optimal building comfort and energy efficiency. This includes the vacuum insulation panels (VIP) by Turvac.

- Trimo enables with its mineral wool insulated panels and modular space solution the highest aesthetic standards and extends architectural capabilities, primarily in non-residential applications. REX Panels & Profiles offers a collection of polyurethane and mineral wool insulated panels for roof and (partition) wall applications.

- Soundcoat provides acoustic solutions used in some of the world’s leading technological innovations.

Financial indicators

Sales

Adjusted EBITDA

Total equity versus net cash

Gross dividend per share (5 years)

* Subject to approval of the profit appropriation by the General Meeting of 27 May 2025, a dividend of EUR 0.31 gross will be paid per ordinary share, or EUR 0.217 net (-30% withholding tax). This dividend will be payable from 4 June 2025. KBC Bank acts as paying agent. Payments for the registered shares will take place via bank transfer to the shareholders’ bank accounts.

Sustainability Indicators

scope 1+2 GHG emissions (market based)

scope 1 GHG emissions

scope 2 GHG emissions (market based)

scope 3 GHG emissions*

* Excl.Cat. 3.15, Investments

3.1 purchased goods & services

3.12 end-of-life treatment of sold products

Intensity KPIs

carbon intensity CO2e per m³ - scope 1+2

carbon intensity CO2e per m³ - scope 3

energy intensity per m³

Circular economy and resource use targets

Waste reduction and recovery

Reduction of operational waste to landfill

Waste reduction and recovery

Diversion of operational waste to recovery

Reduction GHG emissions

Cat. 3.12, End-of-life treatment of sold products

PEFC certified paper in multilayer facings of insulation boards

Recycled content** of mineral wool in insulated panels

* base year: Recticel Group, including Rex

** unweighted average of supplier-reported pre-and post consumer content